ICBA CRA Solutions, formerly CRA Partners, is an ICBA subsidiary and has been providing CRA solutions for the nation’s community banks since 2000.

We offer CRA Education & Training, CRA Support Services, the CRA Collaborative Peer Group, and CRA qualified loans, investments and services. Since our inception, we have helped banks across the country earn meaningful CRA credit through elder financial abuse prevention programs — all with flexible funding options to make it simple for banks to get involved. We guide you through optimizing your CRA Compliance Program from start to finish.

About ICBA CRA Solutions

With rule changes and staff turnover, it can be difficult to fulfill community reinvestment goals and obligations, track them, and clearly communicate value to examiners. We’ll show you how.

Our peer group brings together the best minds in banking to collaborate on CRA strategy and best practices.

We understand the challenges you face meeting regulatory requirements. Our CRA Support can help bridge any gaps your bank may be facing and set you on the best path forward.

Satisfy your bank’s CRA requirements, boost your community relations profile and develop new business relationships, while ensuring safe, secure senior living environments, HUD communities and state veterans homes.

Our latest Community Impact Review highlights examples of how community banks are enhancing the lives of older adults in their communities.

Download the ReviewICBA CRA Solutions/USI Alliance, an ICBA subsidiary, today announced the election to its board of directors Shon Myers, president and CEO of Farmers & Merchants Bank in Miamisburg, Ohio, and Andrew Tinberg, president and CEO of CNB Bank and Trust N.A., in Carlinville, Ill.

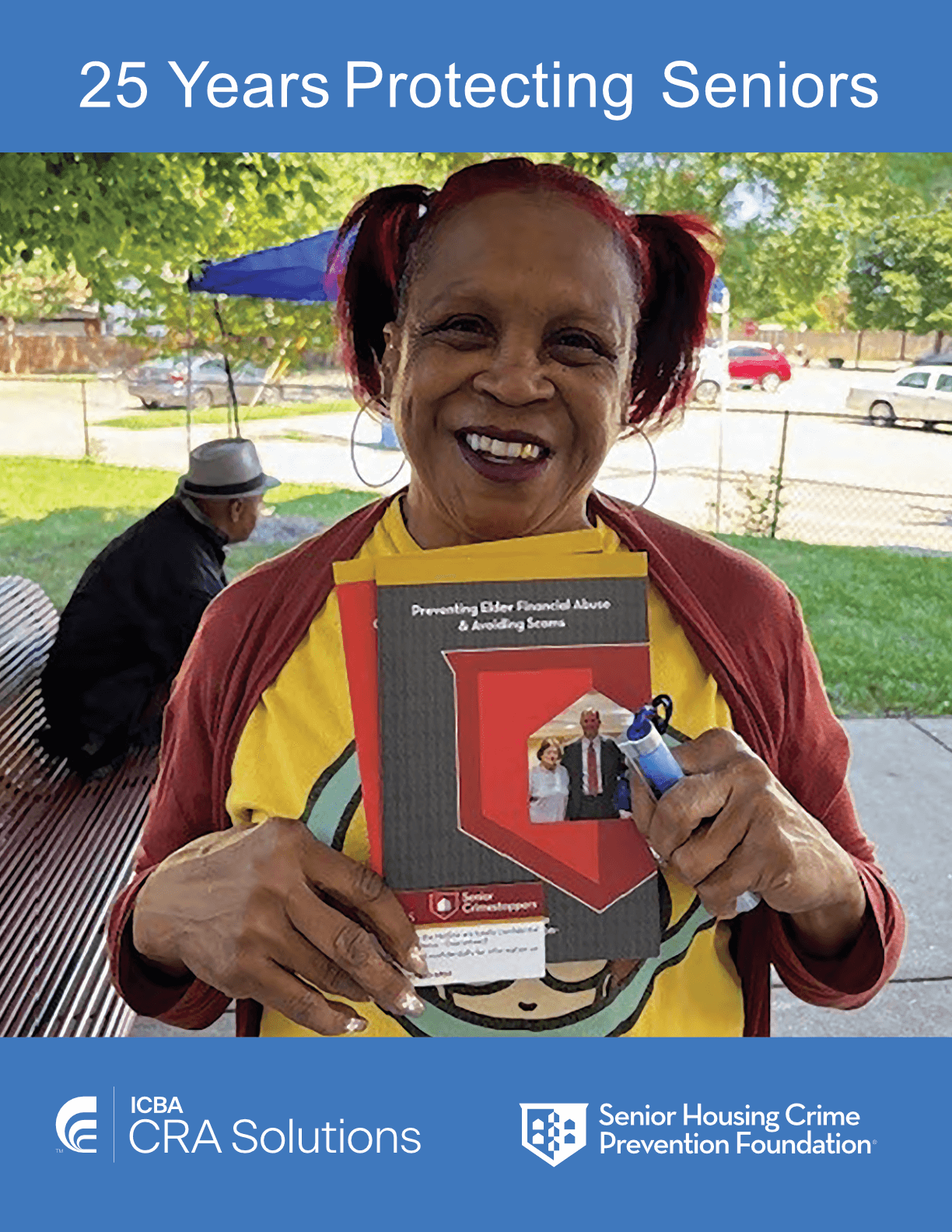

ICBA CRA Solutions, a subsidiary of the Independent Community Bankers of America (ICBA) will celebrate 25 years of helping community banks combat elder financial abuse through partnerships with senior housing and care facilities while fulfilling their CRA commitments. ICBA will commemorate the 25th anniversary of ICBA CRA Solutions at ICBA LIVE 2025 in Nashville, where attendees will celebrate the organization’s legacy and ongoing contributions to community banking.

ICBA CRA Solutions, an ICBA subsidiary, announced a strategic alliance with Ncontracts, which provides integrated vendor, risk, and compliance management solutions to help community banks address Community Reinvestment Act requirements using precise, actionable insights.

ICBA CRA Solutions/Senior Housing Crime Prevention Foundation (SHCPF), an ICBA subsidiary, today announced the election of Gary Teagno, president and founder of Zeus Advisory Services and retired president and CEO of the ICBA Services Network, as chairman of the Senior Housing Crime Prevention Foundation board of directors.

The April 1 Community Reinvestment Act public file deadline is approaching. Below is a refresher on CRA public file requirements.

Please join us in welcoming our newest field rep, Ayana Bass-Myers. Ayana will be serving Maryland, Delaware, Washington DC, Pennsylvania, Virginia, and West Virginia.

"We don’t think we realized how important our support was until we spoke with the residents and saw first-hand how much this program means to them.”

- Bruce Wright, SVP, Retail Banking Regional Manager Lake City Bank, Warsaw, IN

“Our partnership is a valuable component for strengthening our ties to the communities we serve and enables us to provide services to senior citizens who are often the most vulnerable. Their meaningful CRA compliance program aligns with our bank’s mission and goals.”

- Glenn Davis, Vice President, Community Development/CRA Officer Liberty Bank, Middletown, CT

“I was able to join the CRA Collaborative meeting yesterday and thought it was great! Very good information and well run. I am looking forward to being part of the group and future meetings.”

- Jim Rovito, CRA/Fair Lending Officer First Citizens Community Bank, Fredericksburg, PA

Older adults are among those most vulnerable to online scams, financial abuse, and fraud. In accordance with our Senior Housing Crime Prevention Foundation’s mission of protecting seniors, we’ve put together flyers on timely topics with instructions for keeping private data safe, avoiding check fraud, phishing, and more.

We even personalize these documents for our partners so they can be distributed with your bank’s branding.

See Resources